What I Like About Copart (and how I found it)

/My research is qualitative and my focus is primarily on the big economic picture. I prefer to talk about industries more than individual companies, but this is a case where one company is so far ahead that it is the industry. And it’s my favorite type of industry—one that nobody ever thinks about. I found it, like most people, by accident.

In 2014, I totaled my minivan, a 1997 Plymouth Grand Voyager. I didn’t have the kind of insurance that would take the vehicle, so I had to dispose of it myself. I consulted a friend connected to the salvage business, and he told me that there were three places I could sell it—Copart, IAA, or LKQ. A used car dealer also showed interest buying it. But I did more research and chose none of those options. It was not possible to repair it.

Driven by an impulse to save every useful piece of my van, I decided to keep it as a parts vehicle. Then I bought another minivan for $500, saving it from a salvage yard. My plan was to fix the “new” salvage title minivan using parts from my old minivan. It was not a good idea.

In the process of this foolishly expensive experiment (with many more parts “picked” from salvage yards), I learned a lot about the used car business. The people working in and around it—tow truck drivers, mechanics, used car dealers—were always excited to tell me what they knew about the business. If I was thinking beyond my project at the time, I would have looked at doing more research on investing in some part of the automotive industry. But I didn’t. I missed it.

About three years later, while scrolling through a regular stock screen, I noticed a familiar name that met my financial standards. It was Copart. I had never even considered that it could be a public company (I had assumed that it was a small business). That was when I finally looked at the “big business” side of the industry.

What the company does is very simple, but the features of the business and the industry create a complex combination of long-term advantages. Copart is a company that takes damaged vehicles (or salvage title vehicles), usually from insurance companies, and sells them through its online auction house.[1] It generally does not buy vehicles to resell. It makes money by taking a cut from the sales that happen on its website.

This auction house has a very powerful network effect. Sellers join the market because there are buyers, and buyers join the market because there are sellers. It is a self-reinforcing dynamic that takes years to build. Developing relationships with the insurance companies that provide vehicles to sell is a critical competitive advantage, and it takes a dedicated management team to get the operation started.

And Copart has a dedicated management team that lives for the business. The company began, unofficially, as a single scrapyard purchased in 1972 by Willis Johnson (it was officially founded in 1982). His obsession with efficiency and careful planning created a company that grew its brand value before its revenue, using a slow methodical approach. Willis Johnson is no longer the CEO, but his methods are embedded into the culture of the company.[2] The current CEO is his son-in-law, Jay Adair, who started working at Copart when he was 19.[3]

The features of the industry present a unique opportunity. Salvage yards are industrial and undesirable, and it can take a long time (and a lot of money) to build a new yard. In smaller cities that can’t support more than one salvage yard, or larger cities that don’t want another salvage yard, it can lead to a local monopoly. Copart’s global reach enhances this advantage by allowing buyers from anywhere in the world to shop at a salvage yard that would otherwise only have local buyers. That’s the base level.

Long-Term Industry Trends

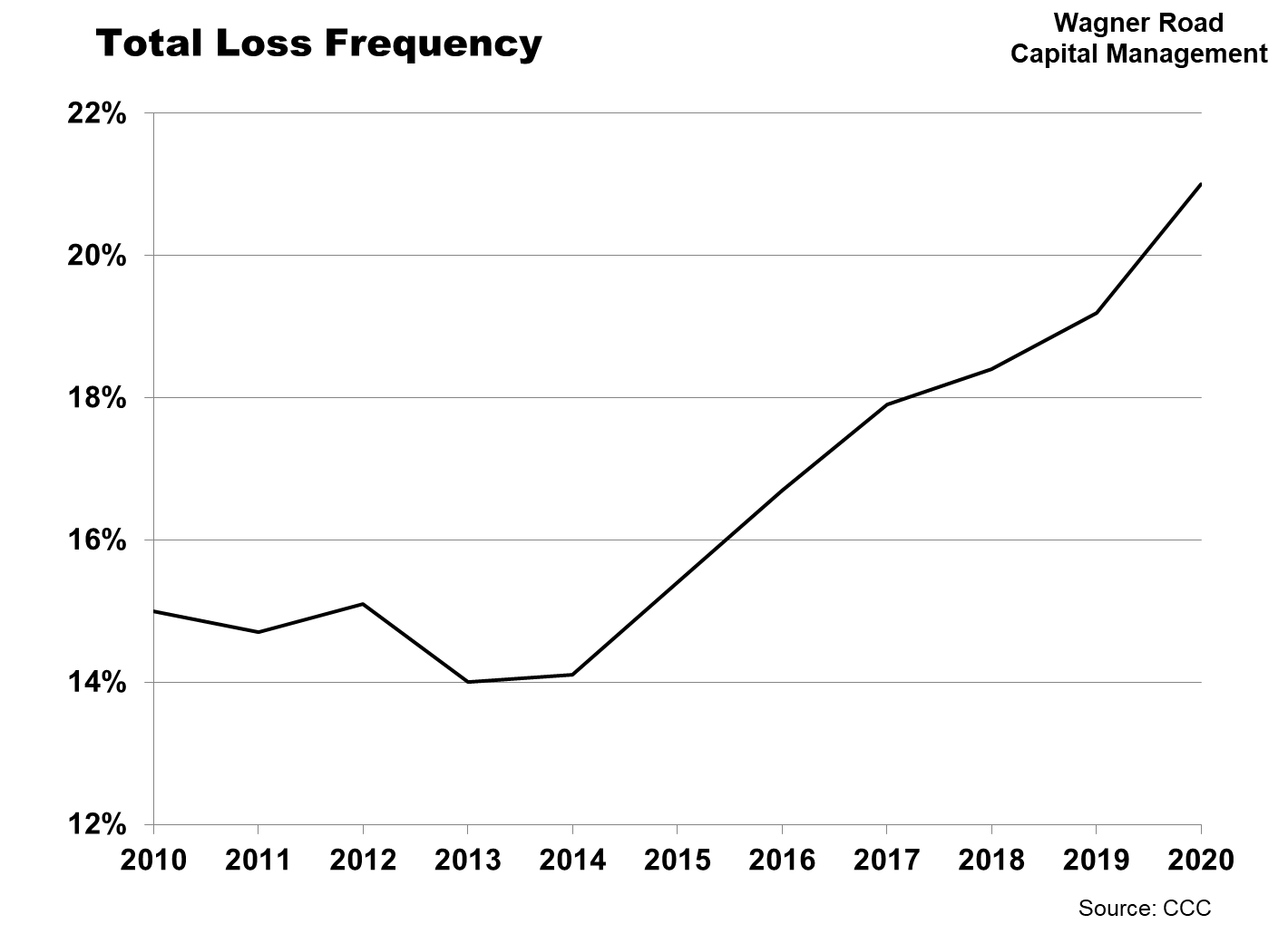

In my view, the most powerful part of the big picture for the industry involves looking at total loss frequency. This metric shows how often a car accident will lead to a car being considered a total loss. It is primarily influenced by the cost of repairing cars and the value of used cars.[4] When combined with the number of cars on the road and the number of accidents, we can get a pretty good idea of where this market is going (Copart’s management says that their key industry metrics are miles driven, accident rate, and salvage rate). Let’s start at the top. Total loss frequency has dramatically increased over the past decade, from about 15% to about 21%.

What this means is that, over the past 10 years, an accident has become more likely to lead to a total loss (and more likely to send a car to Copart’s auction service). There are two major trends causing this increase:

1. Cars on the road are getting older. An older car is much more likely to be considered a total loss because the value is often much less than the cost to repair.

2. New cars are also becoming significantly more expensive to repair. The two main reasons for this are a shift from using steel to aluminum and significantly more electronic components.

Fuel efficiency standards have created the need for lighter materials. The use of aluminum for vehicles has been increasing for decades, and it is expected to keep rising. Aluminum is lighter than steel, but more expensive to repair. [5] It now makes up about 15% of the total weight for a vehicle.

The amount of electronics in vehicles, such as sensors and cameras, has also been increasing for decades. These components are more expensive to replace or repair. Electronics now make up about 35% of a vehicle’s total cost, and are projected to reach 50% by 2030.

Aging cars and more expensive materials and components has led to much higher rates of total loss accidents, but this increase is compounded by more accidents. The proxy for this metric is the total number of miles driven (more miles driven generally leads to more accidents, because accidents per miles driven has been relatively steady).

Combining these factors together, we can take a conservative approach and assume that the total number of miles driven will plateau, as it did from around 2005 to 2015. We can also take a conservative approach by assuming that the accident rate remains similar even with better safety features (the psychology behind this reasoning is that people drive more dangerously when cars have better safety features, leading to the same number of accidents). Even when those two factors stay the same, we can still expect total loss frequency to rise as the vehicles on the road continue to get older and new vehicles continue to become more expensive to repair. When total loss frequency rises, we get more salvage title vehicles.

Short-Term Industry Trends

The other side of the “should this vehicle be repaired” question is the price of used vehicles. The best look at used vehicle prices is the Manheim Used Vehicle Value Index. This index has been relatively stable until the beginning of the pandemic. Before the pandemic, this did not have much of an effect. But after the pandemic started, something strange happened. This is where we start to look at the short term story behind Copart’s business.

I wrote about this in my 2021 second quarter blog: “The reason why used car prices have gone up is because there is a shortage of new cars. If someone wants a different car, but can’t find a new one, they will buy a used one.” The reason behind the shortage in new cars is because there is a shortage of microchips.

Here is my explanation from last year.

“When the pandemic started, the demand for cars fell while the demand for computer equipment took off. To make up for that smaller demand, car manufacturers stopped producing as many cars, while microchip manufacturers adjusted their facilities to focus on the computer equipment market. When the demand for cars returned, the car makers were unable to secure enough microchips, because that production capacity had been filled for other products. … The demand side for microchips also complicates producer choices. The start of the video game cycle, the expansion of 5G networks, and the interest in cryptocurrency mining have all contributed to which markets get priority.”

These trends have continued into 2022, and the wait time for a microchip order is still more than 26 weeks. Used car prices remain elevated, even if they have pulled back a bit over the past two months. [6]

While higher used car prices should lead to more cars being repaired (and fewer cars being totaled), the dramatic increase in used car prices has proven to be a small benefit for Copart, leading to higher average sales prices (and more revenue for Copart because it takes a percentage of the sale price). But the overall effect is mostly neutral—higher sales prices come with lower volume, while lower sales prices come with higher volume. In the short-term, people are also driving at similar rates to pre-pandemic, leading to more accidents and more cars to sell.

The short-term trends continue to be mostly positive. I would expect used car prices to flatten out as the microchip supply backlog returns to normal, but it should have no significant effect on the long-term trends for this industry.[7]

Outside Opportunities

The salvage vehicle auction business is mature inside the United States, but more fragmented in the rest of the world. This is where Copart has the biggest opportunities. The company spent a decade building its brand inside Germany with the intention of spreading to the rest of Europe, and now operates in 11 countries (the U.S., Canada, the UK, Brazil, Ireland, Germany, Finland, the UAE, Oman, Bahrain, and Spain). Part of international expansion requires Copart to adjust for local insurance company expectations. This means that, in the international business, more cars will be purchased by the company to build trust in the auction system, with the expectation that insurance companies will transition to using the auction site. In the latest quarter, roughly 11% of Copart’s service revenues (fees for selling a vehicle) were international, and nearly 40% of vehicle sales revenues (vehicles that Copart buys to resell) were international. Going global also enhances the company’s network effect—about 35% to 40% of the vehicles on the auction site are sold to international buyers.

The other potential market opening for Copart is selling cars that are in good condition, and not just salvage titles. This is not a significant part of the business, but something that management has mentioned as a possibility. Management historically avoids providing comments on big plans until they are almost finished preparing.

Competitive Challenges

There are still reasons to be cautious. The timeline for self-driving cars continues to get closer, and the obvious goal is to have self-driving cars that will not have any accidents, meaning no totaled cars. This is a real risk for the business, but it’s one that is manageable—self-driving cars have been “just around the corner” for years, and they won’t be able to guarantee a world with no accidents right away. In the meantime, vehicles will continue to add more sensors and electronics that are expensive to repair (even if they also have the potential to reduce the chances for an accident), and Copart’s management is clearly aware of the risk.

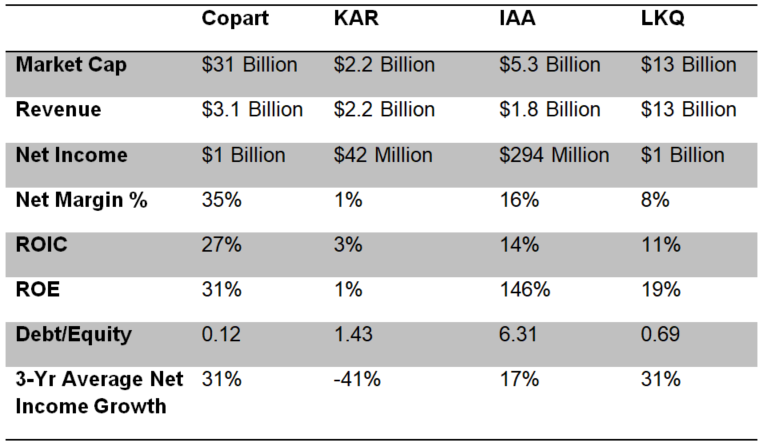

Copart is also not the only company in salvage vehicle business. There are three other major companies that are generally listed as competitors in the industry.

KAR Auction Services (KAR) is sometimes listed as a competitor, but it’s not a direct competitor. The company spun off its salvage auction business 2019. It is an auction, but the business is more focused on dealer-to-dealer sales. I will consider that close enough to include as a peer comparison.

IAA (IAA), the company spun off from KAR, is the only truly direct competitor. It has been a direct competitor for most of Copart’s history, but it has never been managed with as much deliberate, long-term foresight as Copart. The company didn’t move to online-only auctions until 2020, while Copart made the switch two decades earlier.[8] IAA is also much smaller than Copart, operating in only 3 countries, with net income that is only about one third of Copart. IAA is unlikely to get enough resources to catch up, even if it finds a way to grow faster—and it is currently under heavy criticism from an activist investor who wants the company to be acquired.

The next most similar business is LKQ Corporation (LKQ). This company buys salvage title vehicles to dismantle and sell the parts, so it’s more of a parts distributor than a whole car distributor, and its long-term growth strategy is from serial acquisitions. There is some competition for contracts with insurance companies, but the insurance companies will send their totaled vehicles to the place where they can get the most money.

From a financial perspective, none of these companies are as well-rounded as Copart. It has lower debt, faster growth, and better returns on investment.

These numbers are sourced from Morningstar at the end of the quarter.

And that’s a good enough comparison. We don’t need a complicated financial model to know that this company is the best at what it does. That is embedded into the cultural history of Copart, the fundamental features of the business, and the expertise of the current management team.

I also don’t expect the management team to spend every dollar perfectly. Part of having a good business involves relieving bottlenecks in the operation, reducing competitive risks, and finding opportunities to expand—all things that Copart does very well. To have a “miss” on one of those would not be a critical mistake. The real mistake would be to start coasting, and I don’t anticipate that type of mistake.

Summary

If we run Copart through my list of favorite business features, it checks all the boxes.

A fortress balance sheet with strong financial returns.

A company with strong network effects that operates as a monopoly but does not get regulated as a monopoly.

A management team that is heavily invested and includes the company founder.

Many opportunities for reinvesting in growth.

Major long term trends pulling the industry forward.

There are always limitations to this type of analysis, but to have all of these qualities within the same business is extremely rare. I prefer to look at the industry-wide picture, and that is much easier to do when one company is the entire industry. That’s what I like about Copart.

Andrew Wagner

Chief Investment Officer

Wagner Road Capital Management

[1] The buyers are usually dismantlers who sell the parts or used car dealers who fix the cars to sell, but there are also individuals who buy damaged cars to repair for their own personal use.

[2] He is still on the board.

[3] M. Carter Johnson from MCJ Capital Partners wrote a an excellent analysis of Copart’s history. A more comprehensive, numbers-based review of Copart can be found in YoungHamilton’s substack.

[4] Scrap value is also important, but I consider it as more of an adjustment. The higher scrap value, the more likely a car will be considered a total loss.

[5] Some of this is disputed by different sources, but my contacts in the industry assure me that it’s true.

[6] As a follow-up to my comments on inflation, there is one thing that has been proven to be correct: “When conditions change, the Fed’s policies will change.”

[7] If Copart was only buying these cars with the intention of reselling them, instead of taking a cut from the sale, then it would be a very different story. A quick drop in prices would be difficult for any company that is only buying used cars to resell.

[8] Having an online-only operation was a massive benefit for Copart during the pandemic.

Marketing Disclosure: Wagner Road Capital Management is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.